Sustainability reporting

The Transition Pathway Initiative (TPI), part of LSE’s Grantham Research Institute, uses detailed and transparent assessment methodologies, including Carbon Performance and Management Quality, to publish independent ratings of companies. Further details of TPI’s rating methodology is published online, with the most recent version available here.

LSE uses TPI’s analysis to evaluate our own investment holdings against their metrics.

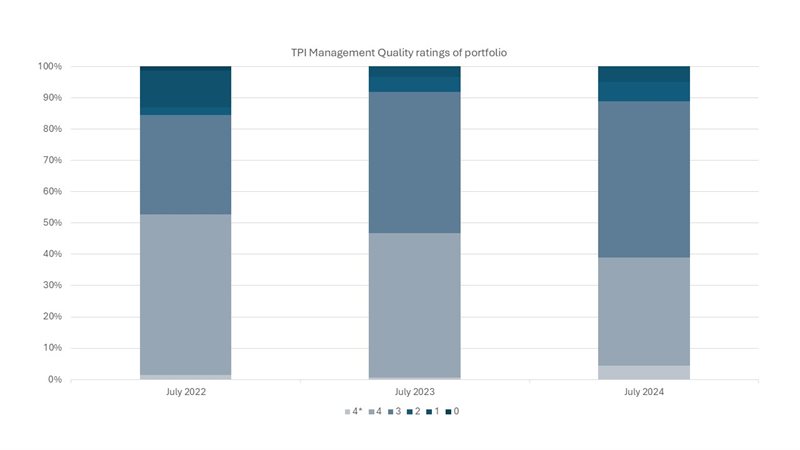

Management Quality

This rating aims to distribute companies according to the management of their greenhouse gas emissions and of risks and opportunities to the low-carbon transition (rated from 0 to 4*, with 4* being the best).

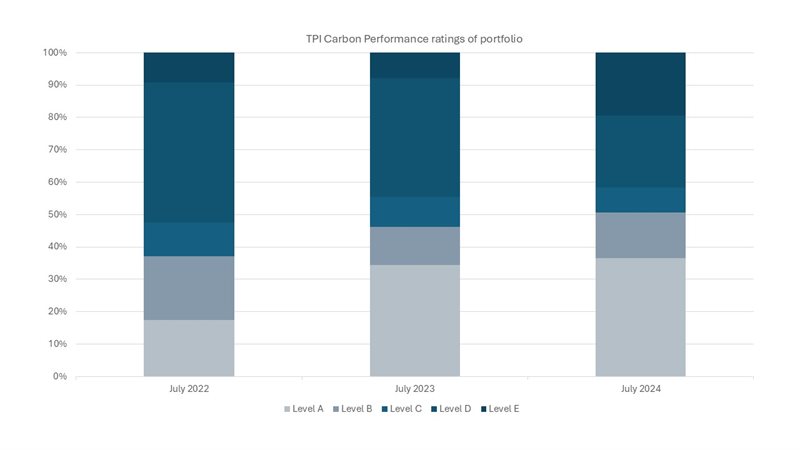

Carbon Performance

This rating analyses companies’ emissions pathways against the international targets and national pledges made as part of the 2015 UN Paris Agreement limiting global warming to below 2 degrees centigrade. The levels A to E represent the following-

Level A- 1.5 degrees

Level B- Below 2 degrees

Level C- National/International pledges made

Level D- Not Aligned

Level E- No or insufficient disclosure

Please note that TPI have not yet rated the following of LSE's investments:

- Private equity holdings – this is not possible as they are unlisted

- Property holdings (Savills and CBRE)

- Cash and fixed income holdings

- Certain public equity holdings; the TPI tool is being added to continually as the Grantham Research Institute’s research progresses, however they have not yet been able to cover all holdings. Their research has, however, already focused on the worst polluting sectors which is helpful in our sustainability reporting analysis

Overall, 64% of all of LSE’s holdings have been assigned a Management Quality (MQ) rating by the TPI tool as at July 2024 compared to 36%, 12% and 9% at July 2023, 2022 and 2021 respectively. This reflects the increased MQ analysis TPI have undertaken throughout 2024 which has significantly increased the proportion of holdings LSE is able to analyse.

In contrast, by July 2024 only 8% of LSE’s investment holdings had been assigned a Carbon Performance (CP) rating by TPI compared to 8%, 6% and 5% at July 2023, 2022 and 2021 respectively; the progress has slowed and there is still only a small proportion of holdings that LSE is able to analyse against TPI’s CP ratings.