LSE has a range of ways in which we monitor to ensure sustainable and responsible investment.

Investment return target

- The long-term investment target return for LSE’s endowments is Consumer Price Index (CPI) + 4.5%. This ensures that LSE’s endowments remain financially sustainable, continuing to grow in value to keep up with inflation and support the cost of vital charitable activities each year, for both current and future generations

- In order to achieve this long-term target, the Investments Sub-Committee has added an allocation to private equity in our endowment portfolios, with an aim of 25% of the portfolio ultimately being invested in private equity.

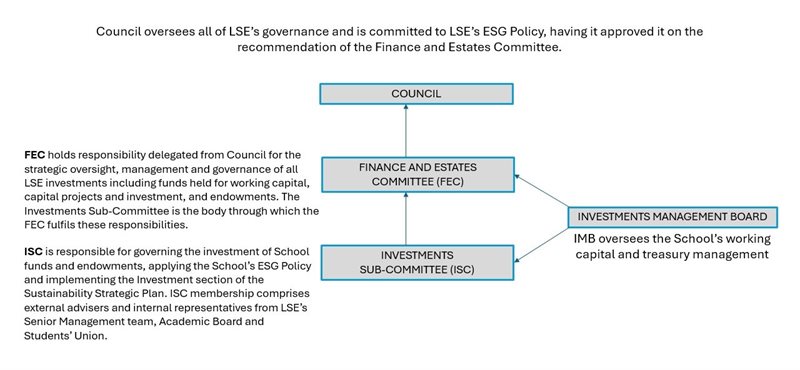

Governance

A number of committees with delegated authority monitor and report to Council on matters relating to Investment and Sustainability.

The Investments Sub-Committee’s membership comprises a range of representatives, including a nominee from the Students’ Union. The full membership can be found here.

Progress so far

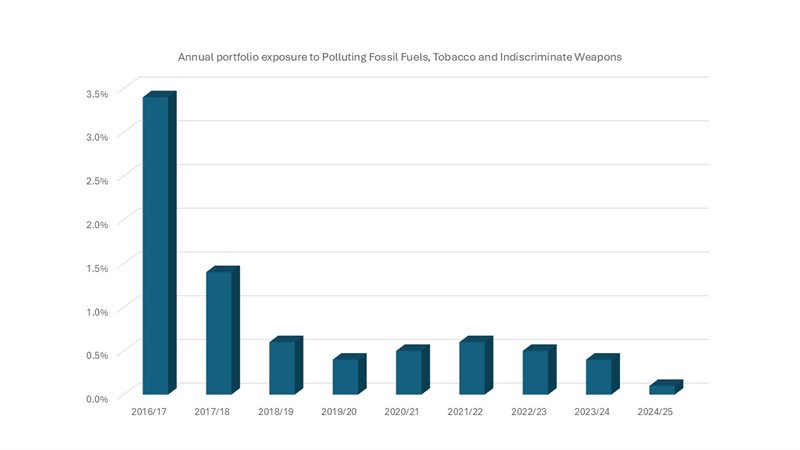

LSE’s Environmental, Social and Governance (ESG) policy involves selecting externally managed funds that minimise indirect investments and exposure in tobacco manufacture, indiscriminate weapons, thermal coal and tar sands (TWTT). Since 2016, the exposure of our investments in those areas has reduced by over 97% from 3.4% of total assets to 0.1% in 2024/25.

Following the 2024/25 review of its ESG policy, LSE is currently exploring further reductions in exposure to these sectors, as appropriate, alongside broadening definitions relating to the exclusion of weaponry.

More on LSE investments and their impact

For more information on LSE investments monitoring and impact go to: